After failing to purchase the US Constitution, communities of crypto bros rally behind a brand-new goal. It’s not a solid investment, there’s no guarantee it will work, and the choice in subject seems arbitrary. But buying an NBA team is the hill that many in the crypto community will die on.

The Krause House DAO is shooting to doom itself by purchasing an NBA franchise. The “decentralized autonomous organization” (named after deceased Chicago Bulls general manager Jerry Krause) has set its sights on raising enough money, though it seems outside of their range.

Krause House has raised 999.85 ETH ($4 million) and aims to get to 1000 ETH ($4.3 million). But the cheapest franchise, The Memphis Grizzlies, sits at $1.5 billion. But the cryptos have rallied around the project, confident that “WAGBAT” (we are going to buy a team) despite the disparity. And if you’re wondering how they’d go about purchasing the team after the money is raised: they don’t know, either. The project doesn’t seem to have a direction or plan for how it would succeed even if it didn’t crash and burn.

The Constitution DAO, for example, ended up going very poorly for most involved, which foreshadows a probable ending for Krause House.

The closest thing the project has to a plan is a basic roadmap of proposals. While the first step focuses on “strengthening our community” with community building, competitions, and workshops, the later phases have little to no plan behind them. When one’s business plan is “succeed,” there’s likely little preventing it from taking a swan dive into a volcano.

Many are excited for the prospect of a fan-owned basketball team, pitching in with hope at a stake in the purchase. However, most don’t see it working, including people actively taking part in the Krause House Discord group, who raise concerns about not only whether the purchase is possible, but also about whether it’s worth it.

The Krause House DAO doesn’t claim that anyone will profit from the endeavor. In fact, the admins emphasize that the project isn’t an investment, and is more of a crowdfunding effort than anything. The main “profit” here is the community resource management, but that doesn’t mean some people aren’t trying to make money off of the entire ordeal

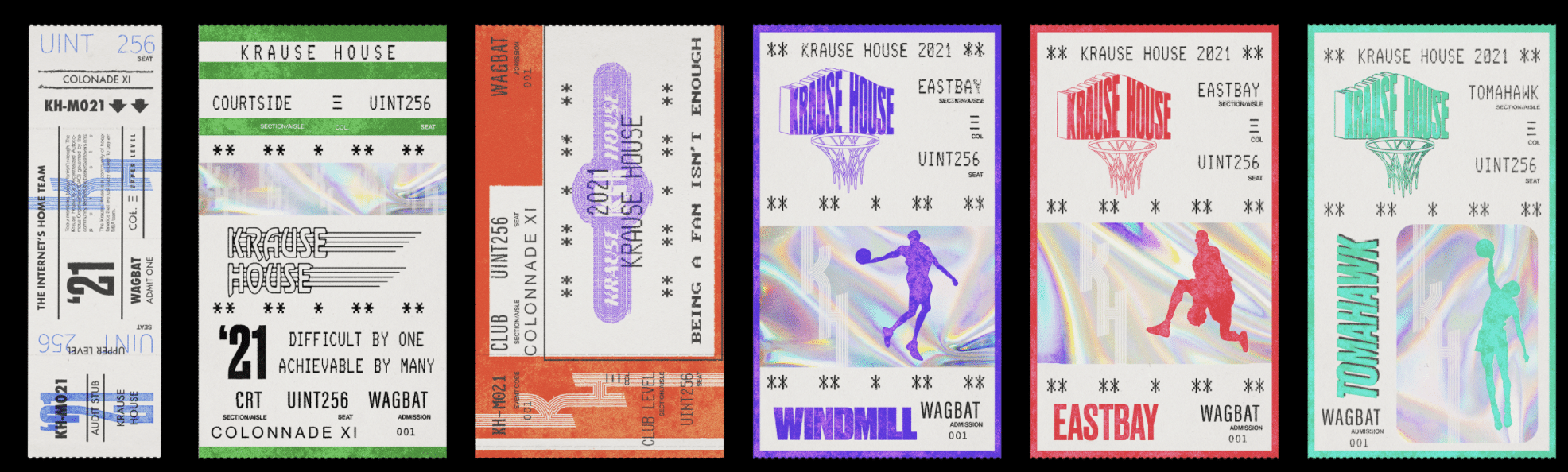

The entire thing seems like a sham—ironic, considering how they’re raising the money in the first place. The DAO has raised its ETH by selling NFTs—specifically special NFTs of NBA tickets—to allocate $KRAUSE tokens.

Credit: Krause House

Much like the NBA-buying scheme, the DAO’s method of moneymaking is a hollow one.

NFTs, or “non-refundable-tokens,” are, like the Krause House project, huge scams justified by “community building”. The tokens act as a currency built from receipts-of-ownership, usually for either stolen art, or easily replicated art. Their fans claim to advocate for artist communities while having very little regard for the actual viability of their actions. ETH currency is mined by burning extremely large quantities of energy, damaging the environment. Money doesn’t grow on trees, but in this case, it does— for the worse.

Krause House’s server is filled with Joker-level “rebellion,” insisting its crowdfunding is anything but a massive trolling campaign. The lack of plan and sufficient funds seems to doom the entire endeavor, but we shouldn’t wave off the rise of DAOs and cryptobros as an economic power. With DAOs buying entire swatches of land, or incorporating themselves into most celebrity merchandising collaborations, their influence is visible in everyday life. As silly as it seems, DAOs should face more scrutiny in the future as crypto becomes more prolific.