Sam Bankman-Fried, the man once dubbed as the ‘King of Crypto’, will not be having a second trial, says US prosecutors.

On November 2nd, the scandalized founder of the cryptocurrency exchange FTX was convicted on seven counts of fraud and conspiracy linked to the company’s downfall.

Apart from the first proceedings, Sam Bankman-Fried was due to face a second trial for six more offenses. Those charges included conspiracy to commit bribery, conspiracy to operate an unlicensed money-transmitting business and campaign finance violations.

However, the trial’s prosecutors stated that they chose not to pursue a second trial because the majority of the evidence that would have been used to convict Bankman-Fried had been presented in the first proceedings.

Who is Sam Bankman-Fried?

Sam Bankman-Fried was raised by two prominent parents who are both known proponents of social justice and are law professors at Stanford University. One could argue that he derived his selfless charitable-giving attitude from them.

Upon graduating from MIT, he joined a trading firm and began donating some of his salary to charities. It’s believed that he thought of cryptocurrency as a way to make the kind of money that could improve the world.

After leaving his trading firm in November 2017, Bankman-Fried and Tara Mac Aulay co-founded Alameda Research. This company was a cryptocurrency trading firm that was generating millions of dollars every day, and after a few years had passed, Bankman-Fried established FTX’s headquarters in Hong Kong.

What is FTX?

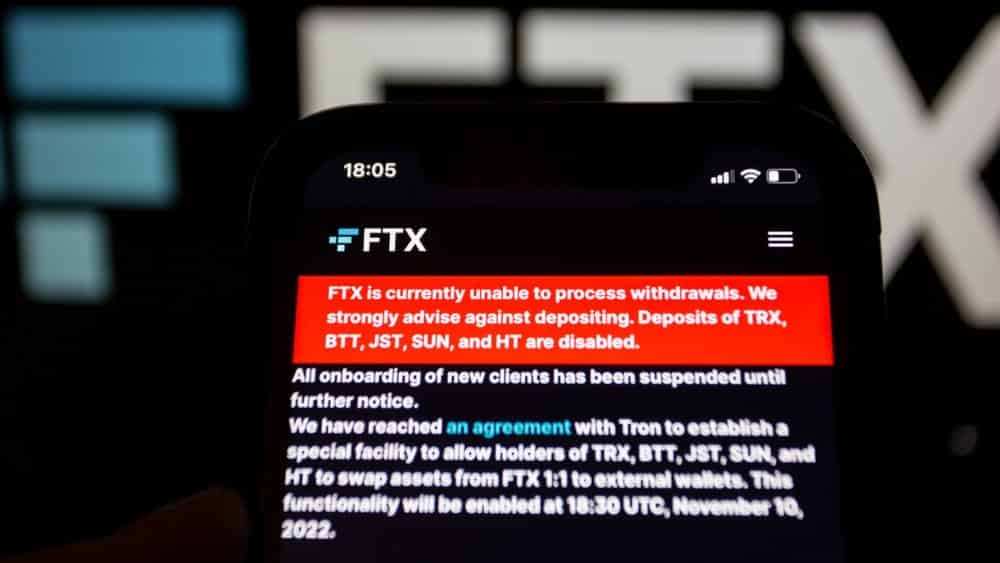

FTX, or Futures Exchange, is a cryptocurrency hedge fund formed by Bankman-Fried and his fellow MIT peer Gary Wang. With this exchange, customers could convert their money to cryptocurrencies like Bitcoin and then store their funds there for security and protection. This exchange was reportedly allowing daily trade worth billions of dollars at the height of its operation.

This was a corporation that had attracted the attention of prominent celebrities and public figures who were eager to endorse and invest in FTX. Bankman-Fried saw himself in the company of celebrities such as Tom Brady and supermodel Gisele Bündchen, as well as important political figures such as former US President Bill Clinton.

FTX had been valued at 32 billion and was on track to becoming an international phenomenon in early 2022 when Bankman-Fried’s empire fell, and it went bankrupt in November of that year.

The downfall of FTX was precipitated by the loss of $8 billion in accounts belonging to customers and investors of the company.

Prosecutors, during Bankman-Fried’s first trial, had produced evidence that Alameda Research, FTX’s sister company, had been receiving money on behalf of FTX customers since the beginning days of the exchange.

Instead of keeping their money safe, as he had promised and was adamant about, Bankman-Fried used their funds to repay Alameda financiers, support his lavish lifestyle, and donate to political causes.

When is his sentencing?

In an attempt to shorten their own sentences, a number of his colleagues, including his ex-girlfriend Caroline Ellison, the CEO of Alameda Research, have entered guilty pleas and testified against him. They’ll receive a sentence at a later time.

However, the former crypto king, Bankman-Fried, was found guilty of five offenses and faces a maximum penalty of 110 years in prison. His sentencing is scheduled for March 2024.

While it’s unlikely that Bankman-Fried will receive the maximum punishment, he might still spend decades in prison.